Since its establishment in 2009, Bitcoin has become one of the most closely watched cryptocurrencies in the world. With the continuous development of blockchain technology and the increasing maturity of the Bitcoin market, more and more investors are turning their attention to Bitcoin. Among numerous predictions, 2025 is considered a significant turning point for the price of Bitcoin. This article will delve into the future trends of btc price, explore factors that may affect its market performance, and provide valuable references for investors.

To predict the price of Bitcoin in 2025, it is necessary to first review the development history of Bitcoin. Bitcoin has experienced multiple price fluctuations since its inception, and its price trend shows significant cyclical characteristics. From the first breakthrough of $1000 in 2013, to the historic high of nearly $20000 in Bitcoin price in 2017, and then to the subsequent rise at the end of 2020 and the beginning of 2021, the significant price fluctuations throughout history have provided powerful references for future predictions.

The volatility of Bitcoin prices is closely related to market sentiment. Whenever market sentiment surges, investors’ risk appetite increases, leading to a rapid rise in Bitcoin prices. When market sentiment is low and funds flow out, the price of Bitcoin will also significantly decline. Therefore, understanding the historical trend of Bitcoin and the factors that affect price fluctuations is crucial for judging future price changes.

The fundamental factors of Bitcoin price mainly include the following aspects:

1. The relationship between supply and demand**

The supply of Bitcoin is limited, with a total limit of 21 million. According to the issuance mechanism of Bitcoin, a “halving” event occurs every four years, and after halving, the block rewards of Bitcoin will be reduced by half, thereby reducing the new supply in the market. This mechanism not only limits the supply of Bitcoin, but can also drive up the price of Bitcoin by reducing the supply of new coins under certain conditions. It is expected that the Bitcoin halving event will occur again in 2024, which may have a significant impact on the price trend in 2025.

2. Participation of institutional investors**

As the Bitcoin market matures, more and more institutional investors are entering this field. The participation of institutional investors such as Grayscale and Bitmain has brought more capital inflows and improved market stability. Institutional investors not only value the short-term price fluctuations of Bitcoin, but also believe in its long-term value storage function as digital gold. Therefore, further involvement of institutional investors in the future may drive up the price of Bitcoin.

3. Changes in regulatory policies**

As a decentralized digital currency, the legal status of Bitcoin varies in different countries and regions. Although the regulation of Bitcoin is still relatively loose globally, more and more countries are beginning to regulate the cryptocurrency market. The regulatory policies of countries and regions such as the United States and the European Union will have a significant impact on the price of Bitcoin. If the regulatory environment becomes stricter, it may trigger short-term market fluctuations and even affect the long-term price trend of Bitcoin.

The price fluctuations of Bitcoin are not only influenced by fundamental factors, but also driven by technical factors. Technical analysis mainly predicts price trends through charts and technical indicators. Technical analysis of the Bitcoin market typically focuses on the following key factors:

1. * * Support and Resistance Levels**

The price of Bitcoin usually fluctuates within a certain range, forming clear support and resistance levels. Support level refers to the situation where the price falls to a certain extent and is supported by buying activity, making it less likely to continue falling. The resistance level is the price level that is difficult to break through when encountering selling pressure during price increases. By observing the historical price fluctuations of Bitcoin, investors can speculate on the possible future price trends.

2. * * Moving Average Line**

The moving average is one of the commonly used tools in technical analysis, which can help investors identify long-term trends in prices. When the price of Bitcoin breaks through a key moving average, it usually means that the market trend has changed. Investors can predict the future price trend of Bitcoin by analyzing changes in the moving average.

3. Relative Strength Index (RSI)**

RSI is an indicator that measures the overbought or oversold situation in the Bitcoin market. When the RSI value exceeds 70, it means that the market is in an overbought state and prices may experience a pullback; When the RSI value is below 30, it means that the market is oversold and prices may rebound. By analyzing RSI, investors can better grasp the timing of buying and selling.

The fluctuation of Bitcoin price is not only related to the cryptocurrency market, but also influenced by the global economic environment. Here are some key factors:

1. * * Global Monetary Policy**

The monetary policies of various countries, especially the United States, have a direct impact on the price of Bitcoin. For example, when the Federal Reserve raises interest rates, it may lead to an appreciation of the US dollar, thereby reducing the attractiveness of Bitcoin. When the Federal Reserve cuts interest rates or implements loose policies, there is a greater possibility of funds flowing into the cryptocurrency market, thereby pushing up the price of Bitcoin.

2. Inflation and Risk Avoidance Demand**

Bitcoin, as a form of “digital gold,” is seen by many investors as a tool to combat inflation. Against the backdrop of increasing global economic uncertainty, more and more investors are beginning to use Bitcoin as a hedge asset, especially in some high inflation countries where Bitcoin has become a tool to hedge against currency depreciation. In 2025, the global economy may face more uncertainty, which will directly affect the demand for Bitcoin.

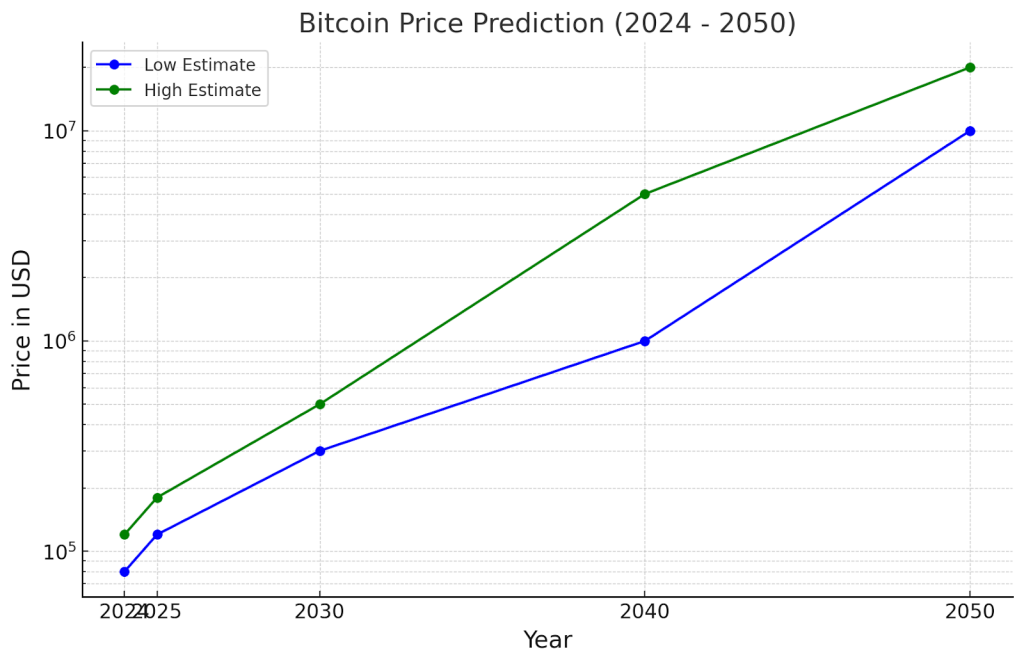

Based on the above analysis, although the price trend of Bitcoin is influenced by multiple factors, it is expected that Bitcoin prices will still maintain high volatility in 2025. In the short term, the price of Bitcoin may fluctuate due to factors such as global economic, policy changes, and market sentiment, but in the long run, as a limited supply asset, its price is expected to continue to rise. Some analysts predict that Bitcoin may break through the $100000 mark by 2025, but this is still a prediction full of uncertainty.

For investors, it is recommended to adopt a cautious investment strategy, diversify risks, and flexibly adjust position ratios based on real-time market conditions. Bitcoin, as a high-risk and high return investment product, is suitable for investors who have risk tolerance and can hold it for the long term.

The price trend of Bitcoin in 2025 is full of uncertainty, but it can be expected that Bitcoin will remain an important asset in the cryptocurrency market as the global economy changes, technology advances, and market demand increases. Investors should consider factors such as fundamentals, technology, and macroeconomic environment when paying attention to the price of Bitcoin, and make rational decisions.